005

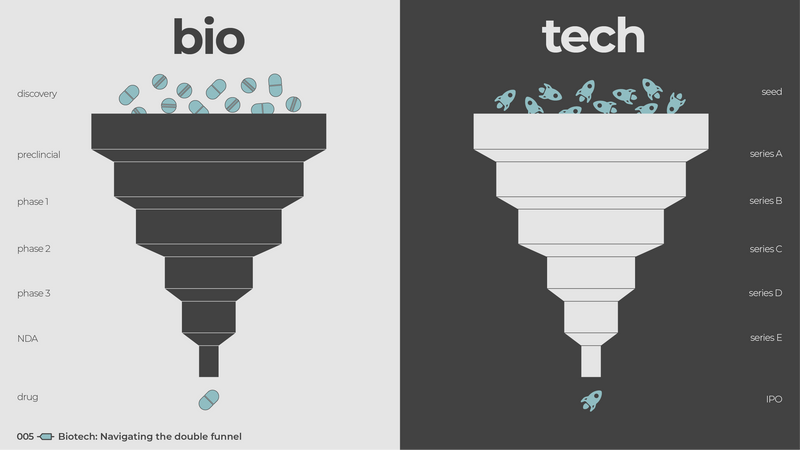

Biotech: Navigating the double funnel

It is no surprise that developing a drug is estimated to cost $2.6B spanning an entire decade. With success rates in the single digits for many diseases, it is a very humbling line of work. The same goes for startups with the majority failing to reach the next funding round.

Biotech startups are essentially navigating these two funnels simultaneously: working on pushing their programs while ensuring enough runway to the next raise. Many biotech companies will go public with the first promising results and long before their drugs are approved.

Another way for startups to exit this funnel midway is through acquisitions by larger pharma companies. The former is innovative - working on new bold ideas, while the latter is structured - excelling in the clinical, regulatory, marketing, and sales aspects of the business.

Funnel shapes will also vary according to disease. The Alzheimer’s funnel, for instance, may have a very wide top (many more candidates) and a very narrow bottom (low success rates). Generally, the ultimate goal is to avoid late stage failures which tend to be the most expensive.

As for drugs that do not make it all the way down the funnel, there is a business of buying and selling failed “assets” and repurposing them for different indications. Because these assets have a specific shelf-life, they become less valuable over time until their patents expire.