004

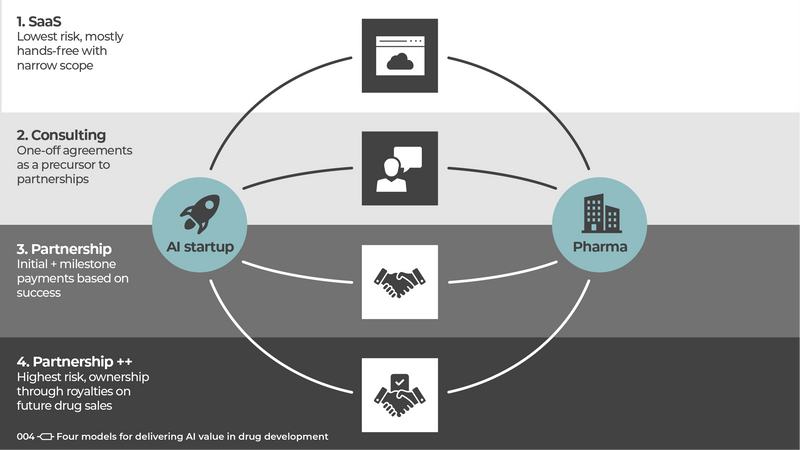

Four models for delivering AI value in drug development

Drug discovery and development is a multi stakeholder process. For early stage AI startups, it is imperative that they work with relatively larger more established companies. Here are four models describing these partnerships in order of increasing risk.

-

Software-as-a-service (SaaS)

The hands-free model where ML tools are made available through the web and users interact with them much like any other software product. These typically involve an annual license fee based on number of users.

This model is best suited for highly specific ML tasks e.g. a microscopy image analysis tool that detects and counts different cell types. To allow for some level of customization, developers may introduce bespoke options e.g. “no-code” interfaces to train your own ML model.

-

Consulting

ML startups and larger biotechs may also engage in one-off consulting agreements. This is where the technology is stress-tested and is often considered a precursor to more involved potential partnerships down the road.

Pharma X might have a specific problem at hand that startup Y promises its ML technology can solve within ~1 year for a lump sum payment of $1M. The additional income here may help get the startup off the ground and serves as proof that their ML technology has utility.

-

Partnerships

These typically come after a couple of successful one-off consulting jobs. It is where risk is truly shared among the parties. Partnerships are open ended explorations that involve working on a general question for a number of years.

It may involve in-licensing a drug, or unleashing the startup’s ML platform to help discover treatments for an indication area the pharma company has expertise in. These come in the form of an initial payment together with milestone payments based on success.

-

Partnerships ++

As startups grow to take on more risk, they may enter partnerships where they have more ownership. This can come in the form of royalties on future drug sales if the program is indeed successful.

This is a great way for pharma to “de-risk the deal”, share it with the startup, and delay some expenses until actual revenue comes in. While the rewards for startups may be significant, they lose out on immediate revenue.

Choice of model will largely depend on how far the startup is in its journey, the nature of the deal, and what each party is expecting to get out of it. They also present options for startups to diversify their revenue streams, especially startups that are not venture-backed.