003

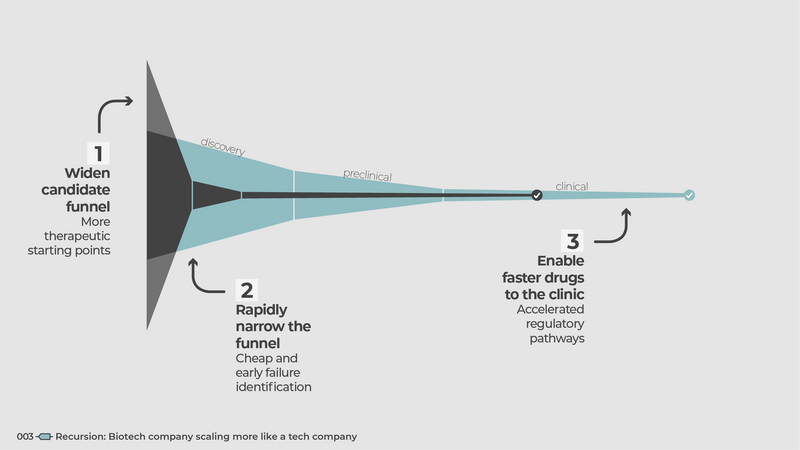

Recursion: A biotech company scaling more like a tech company

Only a handful of ML-centric companies in the health/bio space have gone public. The regulatory documents from these filings provide a good amount of transparency into both the vision and operations. Here are the top 5 highlights from the Recursion S-1 filing.

In a nutshell, Recursion has a massive warehouse in Salt Lake city where robots manipulate cells and knock out different genes. The cells are imaged throughout, and the data is fed into ML models to identify which of the genes targeted make cells happy.

-

A biotech company scaling more like a tech company.

Generally speaking, biotech is primarily R&D-focused while tech is not. The struggle here is to balance the flexibility required for innovation vs the consistency and structure required for scale.

-

Wet-dry lab integration.

Tightly integrating the data generation and analysis sides of the house. The wet-lab relies on heavy automation and is constantly uploading data, which in turn are analyzed by the dry-lab. Decisions are made and fed into the next cycle of experiments.

-

Focus on rare genetic diseases.

A platform-disease fit may be evident if ML models are able to capture significant morphological changes. As the root cause of genetic disease is known, a stronger preclinical -> clinical leap and higher chances of success are likely.

-

Monopoly on diverse talent.

Setting up shop in Utah outside usual hotspots has translated into a monopoly on talent. The roughly 50/50 split between wet and dry scientists is quite uncommon for biotechs where data scientists are often a minority and regarded as service providers.

-

Early specialized platform focus.

The first 5 years were primarily focused on building the platform which comprises specialty components for chemistry, phenotypes..etc. This early investment contributed to clean standardized ML-ready data, some of which has been open-sourced.

$RXRX is down ~65% since going public in April 2021. While this may be a function of the recent poor performance of the entire sector, it may also be that public investors have difficulties valuing platform companies where the core value may not necessarily be in their programs.

You can browse the Recursion S1 filing here↗︎.